“A blueprint for a future government”

In March, the FDA’s HMRC section – the Association of Revenue and Customs – published its report informing any incoming government how an investment of £910m into HMRC would return £11.3bn to the Treasury over the course of a parliament.

Less than a month later, these proposals were included in the Labour party’s plan for large scale investment into HMRC’s compliance and customer service work, in order to help close the tax gap – and were subsequently included in Labour’s election manifesto. Tommy Newell outlines the findings of the report and reports from the launch and its aftermath.

Patrick Straub

The FDA was pleased to host a panel of the UK’s leading tax experts to discuss the findings of our landmark new report, which suggests targeted investment in HMRC could deliver an additional £11.3bn for the treasury.

The report – Funding the Nation: Optimising HMRC – was produced by the Association of Revenue and Customs (ARC), the FDA’s section for members working in HMRC.

It was produced to provide a guide to help any future governments to equip HMRC properly for the future. It does not seek to propose new tax policies or policy changes. Instead, ARC looked at how to ensure that HMRC is supported to deliver an optimum tax administration function that can best support the delivery of public spending priorities.

Launching the report in Parliament in March, ARC President Loz Hutton was joined by Emeritus Professor of Taxation Law at Oxford University Judith Freedman and Chair of the Economic Affairs Finance Bill Sub-Committee Lord Leigh of Hurley to discuss its findings and recommendations, in a panel event chaired by Former Executive Chair and Permanent Secretary at HMRC Sir Edward Troup.

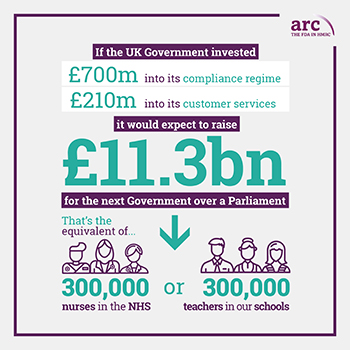

Funding the Nation calls for large scale investment into compliance and customer service to help close the tax gap. It estimates that an investment of £910m would return £11.3bn into the treasury over the course of a parliament.

The key findings outlined by the report were discussed in depth by panellists. These included:

- The direct cost of HMRC’s current 24-minute average customer hold time and poor postal services is estimated to be costing UK businesses around £1bn per annum

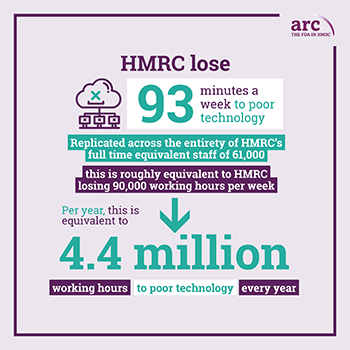

- A survey of HMRC staff found that 15% of the workforce lose more than four hours to poor technology each week (10% of their working time)

- Across the whole department, HMRC staff lose more than 4 million working hours to poor technology each year

- Using historic yields as a guide, ARC has modelled that if the UK government invested £700m into its compliance regime, with a further £210m into its customer services, it would expect to raise £11.3bn for the next government over a parliament

Key recommendations proposed by the report were also debated:

- Large-scale investments into compliance, with an equivalent investment in customer service to close the tax gap

- A long-term staffing and skills plan

- An ongoing technology plan

- A clear data strategy

- Develop a clearer strategy for tax administration

In his foreword to Funding the Nation, Sir Edward wrote that he was “delighted to support the work that ARC has done with this report” and noted that, while it offers “practical choices for HMRC to the government in the new Parliament”, it “does not shy away from the trade-offs involved”.

He echoed these thoughts while chairing the panel discussion, telling attendees: “the pressure on HMRC to do more for less will continue after this year’s general election but you need to understand what good customer service is. If you give it more money, you get more money”.

“The report offers practical choices for HMRC and does not shy away from the trade-offs involved” – Sir Edward Troup

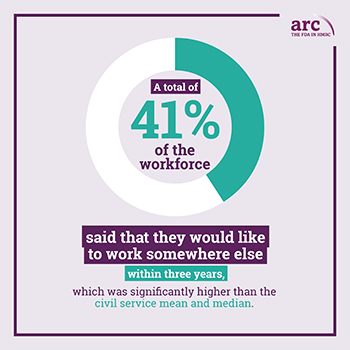

Lord Leigh of Hurley told attendees that “it’s fascinating” to see the analysis of the people working in HMRC. He referenced a survey of ARC members conducted for the report that found a total of 41% of the workforce said they would like to work somewhere else within three years. This is significantly higher than the civil service mean and median, and prompted Lord Leigh to encourage the government to “do everything they can to keep those people with skills and experience”.

“I hope the Public Accounts Committee pick it up… And maybe we should debate it in the House of Lords,” he added.

Judith Freedman commented that she was “very supportive of the recommendations” in the report and “looking forward to working with ARC” to progress them, while also offering a word of caution on AI strategy, which she believes at the moment is still “very high level”.

“I’m very supportive of the recommendations and look forward to working with ARC” – Judith Freedman

“You need a code of practice and safeguards on AI,” she told attendees. “We need transparency on how AI is going to be used in the tax system. You have to keep checking. If you want to retain trust in HMRC, you’ve got to pay for it.”

This was a member-led initiative, with ARC Committee enlisting the help of Inflect – a public affairs and strategic communications agency – to assist with developing the report alongside the FDA.

A huge amount of work went into the eventual 52-page report, with long-serving and now retired ARC member Iain Campbell playing a significant role in the research and policy proposals put forward.

The project was first launched in December 2023, with Sir Edward Troup chairing a roundtable of tax professionals to inform the research. This was a key aspect of the report, as ARC wanted to ensure a broad spectrum of views were taken into account. This is reflected in Funding the Nation’s the acknowledgements page, which includes representatives from the Institute of Chartered Accountants in England and Wales (ICAEW), Macfarlanes, the University of Warwick, the University of Oxford, King’s College London, TaxWatch, Tax Justice UK, Association of Chartered Certified Accountants, the Chartered Institute of Taxation.

Loz Hutton told ARC members he hoped Funding the Nation “would provide a blueprint for a future government, of any political persuasion, for how to get the best from HMRC and its adaptable, hard-working staff”.

Responding to the report, FDA General Secretary Dave Penman drew attention to the report’s findings “that HMRC’s workload has changed significantly over the last decade to mirror changes in the wider economy, as well as demographic pressures”.

Funding the Nation highlighted that for corporation tax, there was a 38% increase in the number of taxpayers between 2014 to 2021; for capital gains tax, there was a 50% increase in the number of taxpayers between 2014 and 2021; for inheritance tax, there has been a 116% increase in the number of taxpayers between 2014 and 2023/24; and for VAT, there has been a 24% increase in the number of taxpayers between 2014 and 2023/24.

“The number of taxpayers is increasing and HMRC now manages more complex tax administration, and more frequently, than it has had in previous decades,” Penman explained. “The department’s ability to adapt to this ever-increasing workload is a success story but civil servants simply can’t keep on delivering more for less.”

He also argued it was “completely unacceptable” that some FDA members in HMRC reported losing hours of working time every week because of poor technology.

“As we approach the upcoming general election, I call on all political parties to take these recommendations on board and pledge to properly invest in HMRC,” Penman continued. “A world class tax administration is in the public interest.”

Penman’s call to the major parties did not fall on deaf ears, as three weeks after Funding the Nation was published, Shadow Chancellor Rachel Reeves MP announced Labour’s plan to close the tax gap, which cited ARC’s Funding the Nation research.

Labour’s plan took on board many of the recommendations put forward in Funding the Nation, with a commitment to “boost compliance activities in HMRC, recovering more tax revenues from those seeking to avoid it” and “invest in technology transformation in the tax system to improve the customer experience and reduce the tax gap”.

These were accompanied by a planned investment of £555m per year in additional HMRC resources, with a target to raise up to £5bn per year by the end of the next Parliament.

The FDA welcomed the inclusion of our proposals in Labour’s plan for large scale investment into HMRC’s compliance and customer service work, and its subsequent inclusion in Labour’s election manifesto. FDA Assistant General Secretary Lauren Crowley said the union was “pleased to see the Shadow Chancellor of the Exchequer engage with our report and that Labour’s plan recognises the scale of investment required”.

“We call on whoever forms the next government to implement our proposals in full to ensure HMRC has the resources necessary to maximise funds for the Treasury and Britain’s public services,” she added. “Delivering more for less is a soundbite. We are offering concrete proposals to help future governments unlock HMRC’s full potential. Only a world-class, well-resourced tax administration can overcome new technological challenges, stay ahead of criminals and fund the nation,” she added.

Read the full report.

Related News

-

Under significant pressure: Interview with Director of Public Prosecutions

Tom Nathan speaks to Crown Prosecution Service Director of Public Prosecutions Stephen Parkinson about CPS’s handling of riots, the importance of impartiality and his plan to help reduce unmanageable prosecutor caseloads.

-

Changing the culture

HM Chief Inspector Sir Martyn Oliver sat down for an ‘in conversation’ event with FDA General Secretary Dave Penman, discussing the pace of change in Ofsted, challenging perceptions and tackling the long hours culture in Education.

-

Hybrid working: Led by evidence, not headlines

Tom Nathan shares the findings and recommendations of the FDA’s recent report on ‘The future of office working in the civil service’.